On December 6, as a strategic investor Build Your Dream (Hereinafter referred to as BYD), purchased 46,630,900 shares of Shengxin Lithium Energy with 2 billion yuan. That means BYD, a downstream battery maker, is once again reaching upstream to grab lithium. The private placement project started in March has finally landed. As a leading enterprise of new energy vehicles, why does BYD attach so much importance to the strategic layout of lithium resources?

This has to mention the wide uses of lithium and the first known to everyone is lithium battery. Nowadays, lithium battery has been used in all aspects of life. Compared with other batteries, lithium battery has high energy density, light weight, high safety and long service life, so it is widely used in life. In defense and aerospace, alloys made of metals such as lithium, aluminum and magnesium can reduce the weight of objects. Not only the solid fuel made of lithium but also lithium compounds has high energy, high burning rate and high specific impulse. It is the ideal propellant for rockets, missiles and spacecraft. So lithium is also known as a strategic emerging mineral resource.

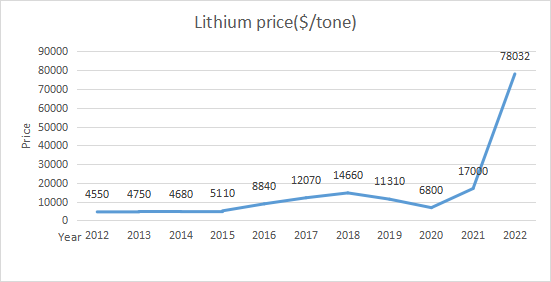

In recent years, with the rapid growth of new energy vehicle production, the structure of global lithium consumption has changed considerably, and the rapid growth of lithium consumption in the battery industry has led to a dizzying trend of lithium, with battery grade lithium carbonate rising more than 400 percent in the Chinese spot market to a record high of more than $70,000 a tonne (a key reference point). The rapid growth in global sales of electric vehicles is driving up prices. Global sales of electric vehicles more than doubled last year to 4.5 million. Rio Tinto estimates that lithium demand will grow by 25-35 per cent a year over the next decade, with a clear supply and demand gap expected between 2025 and 2030.

Carmakers such as BYD and Tesla and their suppliers have learned from semiconductor shortages over the past two years. Growing demand for electric cars, spurred by a spike in oil prices caused by the Russia-Ukraine war, is accelerating the scramble for components and raw materials. The battle for battery supply will support lithium prices for a long time. Although lithium is abundant around the world, it is not easy to extract. Growing concerns about mining companies' environmental, social and governance issues have made it harder to extract.

As the first flagship investment project of Globelink China Investment in Africa, Hudson has developed rapidly in recent years and formed a complete supply chain in mining industry. Since its established, Hudson has been committed to the legal and conflict-free extraction of lithium resources, taking responsibility for environmental, social and governance issues, and ensuring that the entire extraction process is regulated by the Responsible Mineral Initiative Association.